31+ percent of salary for mortgage

Lenders want to make sure these expenses dont exceed 36 of your monthly. Lock Your Rate Today.

The Costs Of Insecurity Pay Volatility And Health Outcomes

Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You.

. Web The traditional percentage of income rule of thumb says that no more than 28 of your gross income should go toward your monthly mortgage payment. In that case NerdWallet recommends. Web The 28 mortgage rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg principal interest taxes and insurance.

Comparisons Trusted by 55000000. If youd put 10 down on a 333333 home your mortgage would be about 300000. President Biden has proposed a 52 percent pay raise for federal employees for January 2024 as part of a budget plan that kicks off what is shaping up to.

Compare the Best Mortgage Lender that Suits You Enjoy Our Exclusive Rates. Ad 10 Best House Loan Lenders Compared Reviewed. You pay 1000 toward the principal and interest 150 toward property taxes 100 toward homeowners insurance and 50 in.

Compare Loans Calculate Payments - All Online. Web Multiply your total monthly gross income by 31 percent to determine your maximum monthly housing expenses. Thats up from 24 in December and the highest.

Web A mortgage payment now costs 31 of the typical American household income according to Black Knight. Ad Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments. Ad Compare Home Financing Options Get Quotes.

Ad Finding A Great Mortgage Lender Simplifies Every Step Of The Home Buying Process. Web According to the 2836 rule your mortgage payment -- including taxes homeowners insurance and private mortgage insurance -- shouldnt go over 28. Ad Explore Quotes from Top Lenders All in One Place.

Web Based on your monthly income of 6000 your back-end ratio would be about 44 percent. Web How much income is needed for a 300K mortgage. Web Lets say your gross income is 5000 per month.

Web The total of your monthly debt payments divided by your gross monthly income which is shown as a percentage. Get the Right Housing Loan for Your Needs. This calculation is for an individual with no expenses.

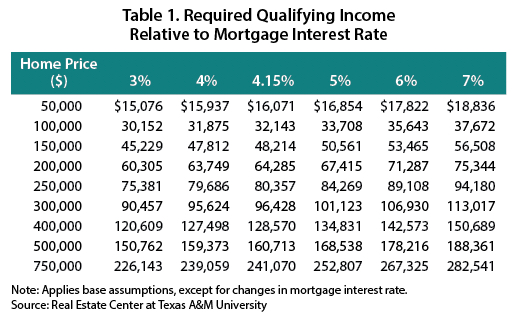

These expenses include your principal and interest payment. Web A 300000 house with a 5 interest rate for 30 years and 15000 5 down will require an annual income of 77087. Compare Offers Side by Side with LendingTree.

Get Instantly Matched With Your Ideal Mortgage Lender. Web For example a 300000 mortgage with a 10 down payment at todays average 30-year rate of 523 would cost around 1487 per month for a 30-year loan. Save Real Money Today.

Begin Your Loan Search Right Here. Your DTI is one way lenders measure your ability to manage. Ideal debt-to-income ratio for a mortgage For conventional loans.

Web Back-end DTI includes all of your debt payments in addition to the proposed mortgage payment. Web To determine how much income should be put toward a monthly mortgage payment there are several rules and formulas you can use but the most popular is the. Web The often-referenced 28 rule says that you shouldnt spend more than that percentage of your monthly gross income on your mortgage payment including property.

Web Assuming relatively low debts 300 per month and a 30 mortgage rate this person might be able to borrow up to 564000 for a mortgage.

Mortgage Calculator Enter Your Income See Your Home Price Mortgage Rates Mortgage News And Strategy The Mortgage Reports

How Much Of Your Salary Should Go Towards A Home Loan Movement Mortgage Blog

How Much Of My Income Should Go Towards A Mortgage Payment

Prosper10k12312010 Htm

How Much Of Your Salary Should Go Towards A Home Loan Movement Mortgage Blog

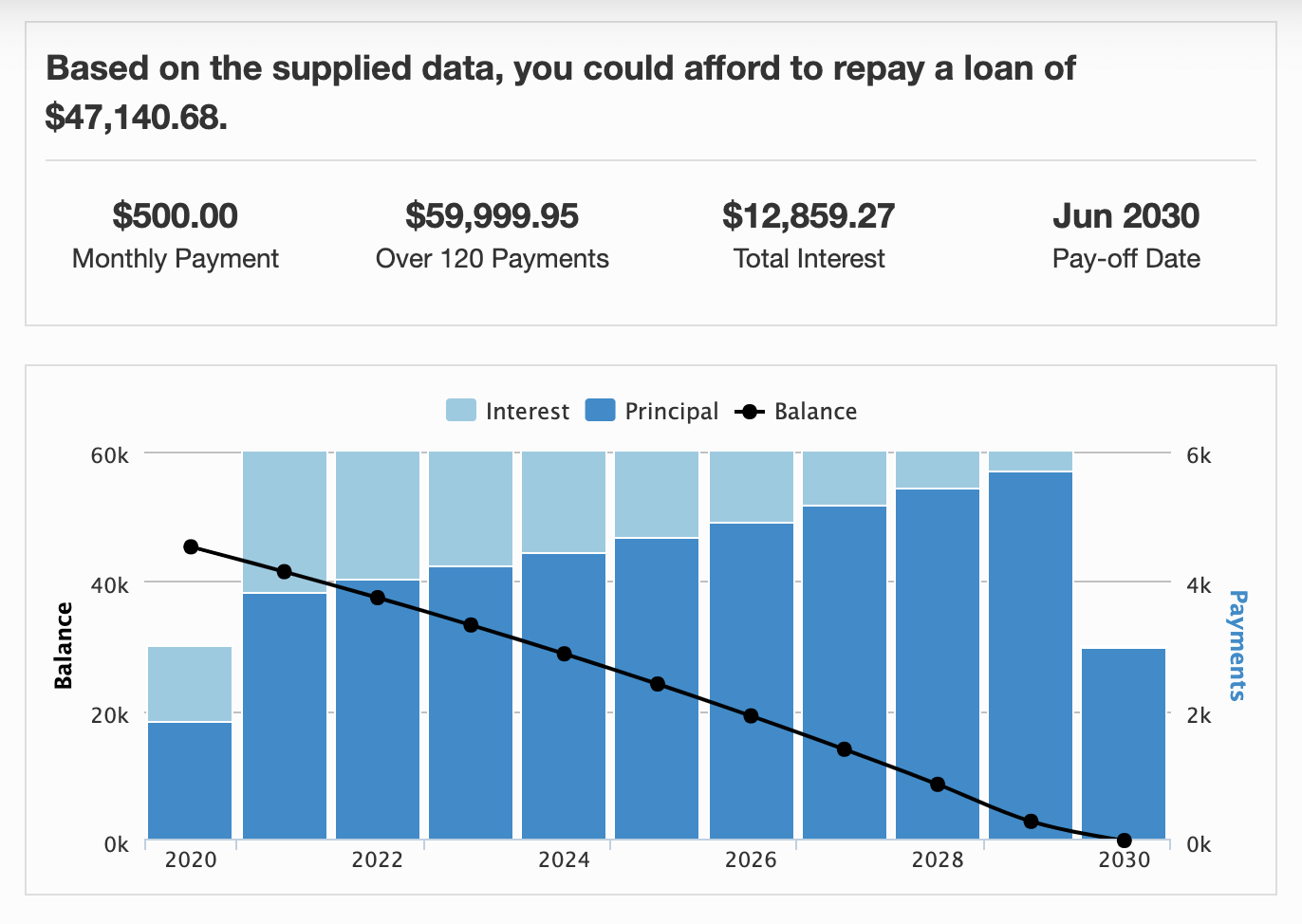

Loan Affordability Calculator Crown Org

How Much Of My Income Should Go Towards A Mortgage Payment

The Costs Of Insecurity Pay Volatility And Health Outcomes

2022 23 Huntsville Isd Benefit Guide By Fbs Issuu

How Much To Spend On A Mortgage Based On Salary Experian

How Much Of My Income Should Go Towards A Mortgage Payment

:max_bytes(150000):strip_icc()/MortgateRates.Fed.StL-0099d59e398e4f239bc0cc4154e04cb7.jpg)

Mortgage Calculator

How To Figure 31 Of My Mortgage To Income Budgeting Money The Nest

Income To Mortgage Ratio What Should Yours Be Moneyunder30

What Is The 28 36 Rule Lexington Law

![]()

The Measure Of A Plan

Article Real Estate Center